In the ever-evolving landscape of sales and customer success, staying ahead of the competition requires the adoption of innovative tools and methodologies.

Enter Altify and ChatGPT, two powerful technologies that, when combined, offer a synergistic approach to revolutionizing sales processes and enhancing customer engagement.

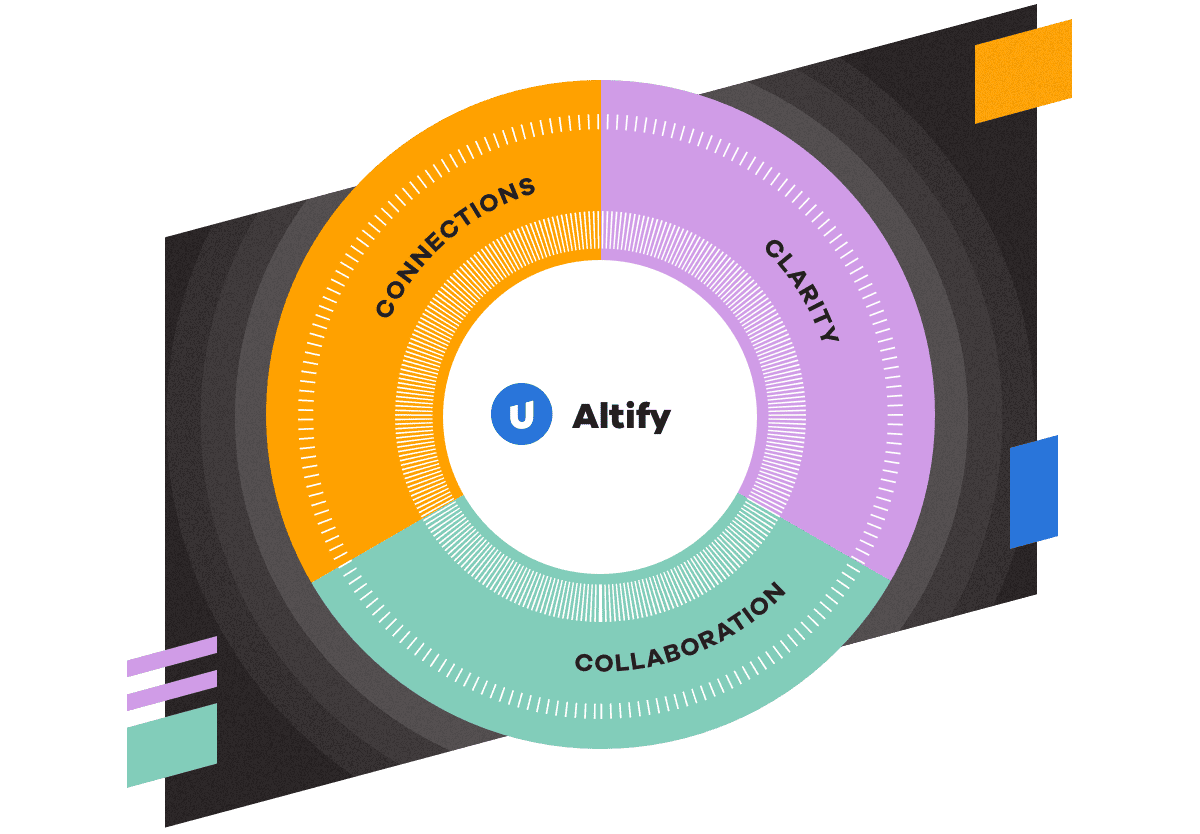

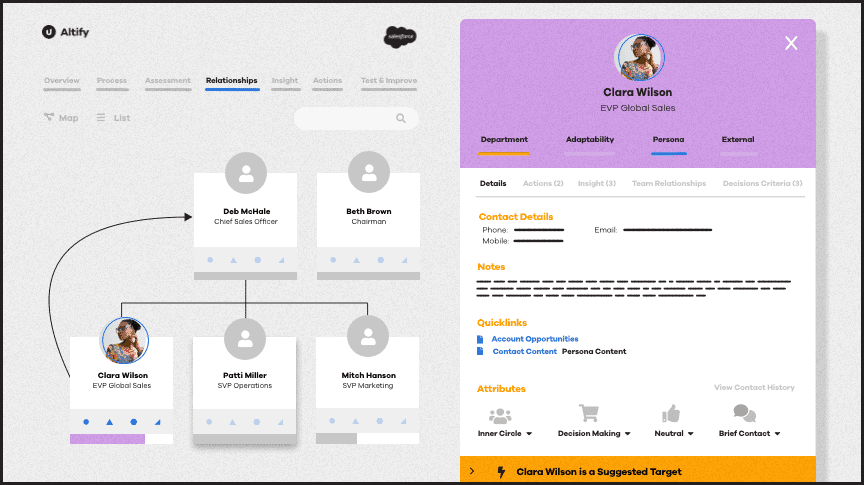

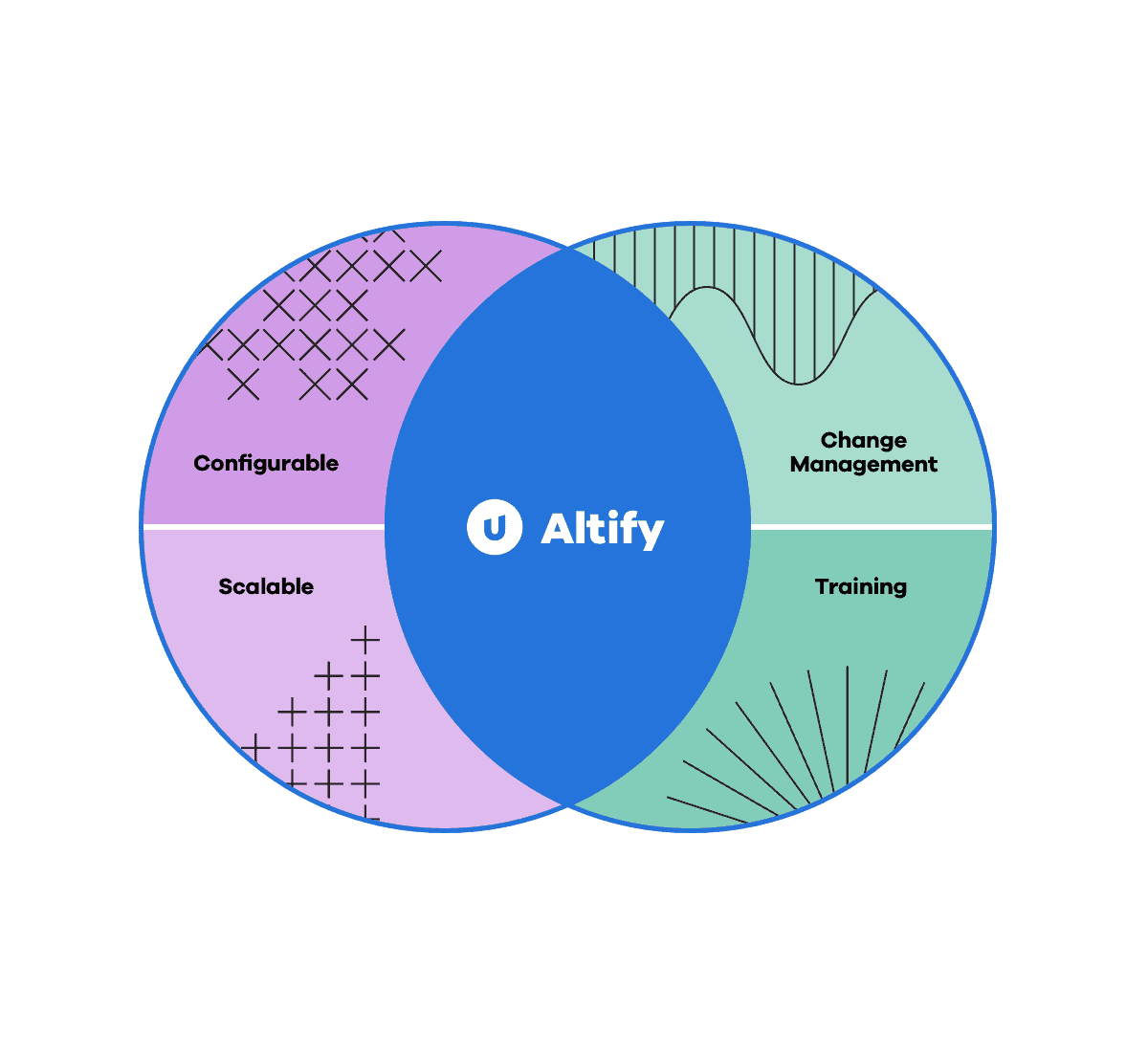

Altify and ChatGPT can empower sellers and customer success teams by streamlining research on personas and industries, optimizing discovery and qualification, mastering sales methodologies, harnessing competitive intelligence, and facilitating effective summarization of calls and actions.

- In this article, we explore 5 Ways to use ChatGPT with Altify for high value insights.

- In this article, we explore 4 ways NLP AI and Sales Methodology will join forces.

As Altify solutions are 100% Salesforce native applications, this means that with the announcement of Sales GPT by Salesforce, and as a Crest Partner, we will have early access to generative AI features and capabilities from Salesforce.

With Salesforce Sales GPT, powered by Einstein GPT, customers will be able to harness the combined power of generative AI, Salesforce and Altify and embark on an entirely new journey of delivering value across your revenue team and to your customers.

*Upland Software, Inc. is not affiliated with, sponsored by, endorsed by or otherwise supported by OpenAI.